An Incredible Opportunity To Own a 130 Unit Cash-Machine in Edmonton

130 Units | CMHC-Backed Financing | 13.23% Cash-on-Cash Returns

Edmonton’s rental market is undersupplied, creating an opportunity for stable, high-yield multi-family investments. This 130-unit development in Highlands is structured to generate $255,846 in annual net returns with CMHC-backed financing optimizing leverage and long-term gains. With a 4.98% cap rate and 13.23% cash-on-cash returns, this asset is positioned for strong cash flow and appreciation.

OVERVIEW

130-Unit Multi-Family Development – Highlands, Edmonton

$32M

TOTAL COST

4.98%

PROJECTED CAP RATE

$255,846

ANNUAL NET RETURNS

13.23%

CASH-ON-CASH RETURNS

1.19

DSCR

Unit Mix and Floorplans

This development is structured for long-term rental income

with a balanced unit mix targeting diverse tenant demand.

65 x 1-Bed, 1-Bath (588 SqFt)

25 x 2-Bed, 1-Bath (878 SqFt)

40 x Studio (478 SqFt)

53 Underground Parking Stalls

23 Surface Parking Stalls

40 Storage Lockers

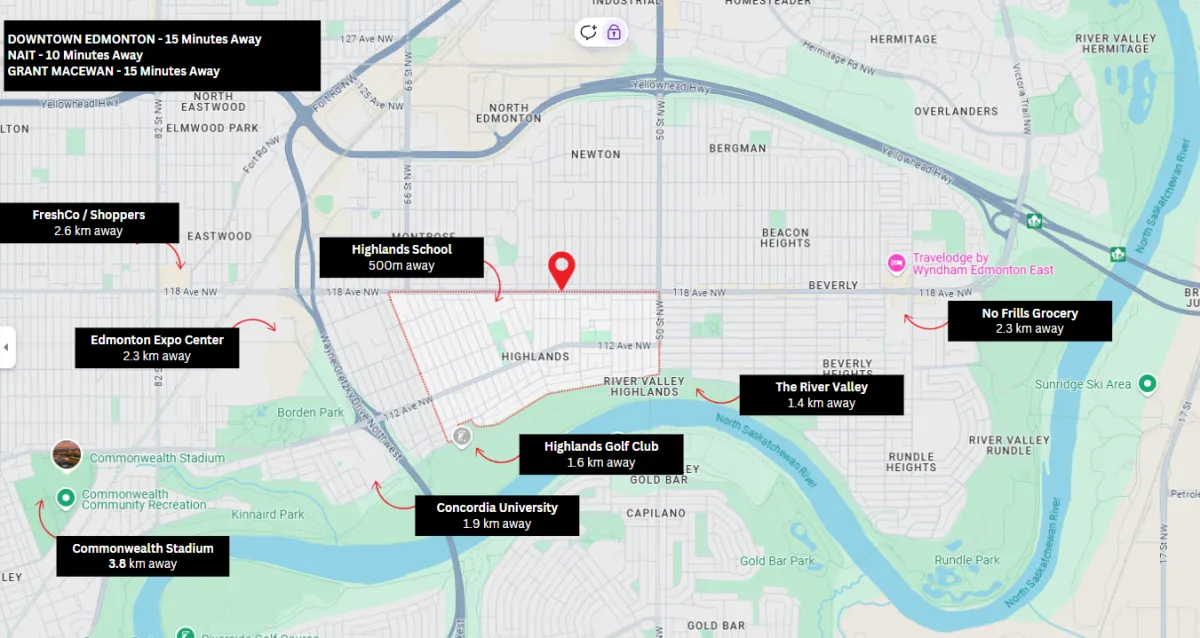

Location Analysis

500m to Highlands School (K-9)

1.9km to Concordia University

10 min to NAIT, 15 min to Grant MacEwan University & Downtown Edmonton

Adjacent to River Valley, Highlands Golf Club, and arterial transit routes

Stable neighborhood with increasing property values ($443K-$712K avg. home price range)

Market Positioning

Rental Market Conditions

Highlands has near-zero rental vacancy. Only 1 current rental unit available in the immediate area, with 5 in adjacent neighborhoods.

Demand for professionally managed, modern multi-family rentals significantly outpaces supply.

Market Positioning

Asset Performance

Stabilized operations expected within market absorption rates.

Edmonton’s MLI Select-backed rental assets consistently outperform traditional financing models.

Comparable properties in adjacent areas are trading at similar or lower cap rates, confirming market alignment.

Acquisition & Development Process

Commitment Structure

1% deposit to hold, 2.5% upon firm agreement, 5% equity contribution upon CMHC approval.

Due Diligence

14-day contract review with up to two extensions.

Approval & Construction

CMHC approval triggers land transfer and first construction draw.

Pre-Lease Strategy

Marketing and tenant acquisition begin six months prior to completion.

Risk Management

$1,000/day penalty for CMHC document delays; 20% deposit forfeiture if approval fails due to investor-side negligence.

Financial Data & Supporting Documentation

Full Cash Flow & Sensitivity Analysis

Occupancy Projections

Expense Breakdown

Debt & Equity Structuring Details

For Next Steps, Contact Us Directly

If you have received this page, we have sent it to you directly.

Make sure to reach out to Joshua or Mike, depending on who

you have been working with.

This project will be sold ASAP. Please do not wait if you think this project is for you!

Joshua Clark